2022知到答案 Cost and Managerial Accounting(成本管理会计) 最新知到智慧树满分章节测试答案

- 见面课:Capital Budgeting

- 见面课:Comparison of Cost Accounting Systems

- 见面课:Comparison of Product Costing Systems

- 见面课:Cost Behavior ,CVP Analysis,and Short-term decision

- 见面课:Cost Behavior, CVP Analysis, and Short-term decision

- 见面课:Preparation of Master Budget

- 见面课:Standard Costs and Variance Analysis

- 见面课:Standard Costs and Variances

- 第一章 单元测试

- 第二章 单元测试

- 第三章 单元测试

- 第四章 单元测试

- 第五章 单元测试

- 第六章 单元测试

- 第七章 单元测试

- 第八章 单元测试

- 第九章 单元测试

- 第十章 单元测试

- 第十一章 单元测试

- 第十二章 单元测试

见面课:Capital Budgeting

1、问题:A financial analyst determines the after-tax operating cash flow for a proposed project’s first year using the following estimates. 财务分析师使用以下估计确定拟议项目第一年的税后经营现金流Sales revenue 销售收入 $2,000,000Operating costs 运营成本$1,000,000Depreciation 折旧$200,000Income tax rate 所得税率35% The after-tax operating cash flow for this project in its first year is:( )第一年的税后经营现金流为( )

选项:

A:$520,000

B:$650,000

C:$720,000

D:$850,000

答案: 【$720,000】

2、问题: After calculating both the simple payback period and the discounted payback period for a project, the discounted payback period is:( )计算一个项目的静态投资回收期和动态投资回收期后,动态投资回收期为: ( )

选项:

A:shorter because the time value of money raises the value of the cash flows.更短,因为货币的时间价值提高了现金流的价值

B:longer because the time value of money raises the value of the cash flows.更长,因为货币的时间价值提高了现金流的价值

C:shorter because the time value of money lowers the value of the cash flows.更短,因为货币的时间价值降低了现金流的价值

D:longer because the time value of money lowers the value of the cash flows.更长,因为货币的时间价值降低了现金流的价值。

答案: 【longer because the time value of money lowers the value of the cash flows.更长,因为货币的时间价值降低了现金流的价值。】

3、问题: A depreciation tax shield is a reduction in income taxes折旧税盾是折旧费用引起的所得税的减少

选项:

A:对

B:错

答案: 【对】

4、问题:Discounted cash flow model is generally considered the best model for long-range decision making ( ) 贴现的现金流模型被认为是长期决策的最佳模型

选项:

A:对

B:错

答案: 【对】

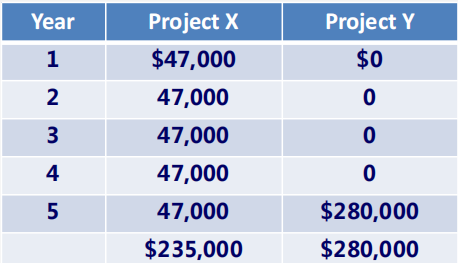

5、问题:Staten Corporation is considering two mutually exclusive projects. Both require an initial outlay of $150,000 and will operate for five years. The cash flows associated with these projects are:Staten 公司正在考虑两个相互排斥的项目。两者都需要 150,000 美元的初始支出,并将运营五年。与这些项目相关的现金流量是:( ) 折现率为10%的现值系数12345复利现值系数0.9090.8260.7510.6830.621年金现值系数0.9091.7362.4873.1703.791Staten’s required rate of return is 10%. Using the net present value method, which one of the following actions would you recommend to Staten? Staten公司要求的回报率为 10%。使用净现值法,您会向 Staten 推荐以下哪一项行动?( )

折现率为10%的现值系数12345复利现值系数0.9090.8260.7510.6830.621年金现值系数0.9091.7362.4873.1703.791Staten’s required rate of return is 10%. Using the net present value method, which one of the following actions would you recommend to Staten? Staten公司要求的回报率为 10%。使用净现值法,您会向 Staten 推荐以下哪一项行动?( )

选项:

A:Accept Projects X and Y. 接受X和Y项目

B:Reject Projects X and Y. 拒绝X和Y项目

C:Accept Project Y, and reject Project X. 接受Y拒绝X项目

D:Accept Project X, and reject Project Y 接受X拒绝Y项目

答案: 【Accept Project X, and reject Project Y 接受X拒绝Y项目】

见面课:Comparison of Cost Accounting Systems

1、问题:Which of the following businesses would most likely use job order costing(分批法)?( )

选项:

A:A print shop that specializes in wedding invitations.一家专门从事婚礼请柬的印刷店。

B:A company that makes frozen pizzas.一家生产冷冻比萨饼的公司。

C:A brewery. 一家啤酒厂。

D:An oil refinery. 一家炼油厂。

答案: 【A print shop that specializes in wedding invitations.一家专门从事婚礼请柬的印刷店。】

2、问题:Which of the following businesses would most likely use process costing(分步法)?( )

选项:

A: A law firm.

B:A maker of frozen orange juice.

C:A hospital.

D:An accounting firm.

答案: 【A maker of frozen orange juice.】

3、问题:If CustomCraft uses job order costing, each of the following is true, except: 如果 CustomCraft 使用分批法进行成本核算,则以下每一项都为真,除了( )

选项:

A: Individual job cost sheets accumulate all manufacturing costs applicable to each job 单个成本计算单累计适用于每个工作的所有制造成本

B:Direct labor cost applicable to individual jobs is recorded when paid by a debit to Work in Process Inventory and a credit to Cash. 对单个订单的直接人工成本记录为:借记在产品存货,贷记现金。

C:The amount of direct materials used in individual jobs is recorded by debiting the Work in Process Inventory account and crediting the Materials Inventory account.单个订单中使用的直接材料的会计处理为:借记在产品存货,贷记库存材料存货。

D:The manufacturing overhead applied to each job is transferred from the Manufacturing Overhead accountto the Work in Process Inventory account将制造费用从分配给特定订单的成本流转是:从制造费用帐户转移到在产品存货帐户

答案: 【Direct labor cost applicable to individual jobs is recorded when paid by a debit to Work in Process Inventory and a credit to Cash. 对单个订单的直接人工成本记录为:借记在产品存货,贷记现金。】

4、问题:4. The use of activity-based costing is indicated when it is suspected that each of a firm’s product lines consumes approximately the same amount of overhead resources but the current allocation scheme assigns each line a substantially different amount. 当怀疑公司的每条产品线消耗大致相同数量的间接费用资源,但当前分配方案为每条产品线分配显着不同的数量时,就会使用基于作业的成本核算方法。 ( )

选项:

A:对

B:错

答案: 【对】

5、问题:If Power Products uses process costing, which of the following are likely to be true: ( )如果 Power Products 使用基于过程的成本计算法,以下哪项很可能是正确的:

选项:

A:The production processes are high volume. 大批量生产。

B: The products use different amounts of direct labor.产品使用不同数量的直接人工。

C:The products are created with repetitive processes. 产品是通过重复过程创建的。

D:The products are created to customer specifications.产品是按照客户规格制造的。

答案: 【The production processes are high volume. 大批量生产。;

The products are created with repetitive processes. 产品是通过重复过程创建的。】

见面课:Comparison of Product Costing Systems

1、问题:Which of the following businesses would most likely use job order costing(分批法)?( )

选项:

A:A print shop that specializes in wedding invitations.一家专门从事婚礼请柬的印刷店。

B:A company that makes frozen pizzas.一家生产冷冻比萨饼的公司。

C:A brewery. 一家啤酒厂。

D:An oil refinery. 一家炼油厂。

答案: 【A print shop that specializes in wedding invitations.一家专门从事婚礼请柬的印刷店。】

2、问题:Which of the following businesses would most likely use process costing(分步法)?( )

选项:

A: A law firm.

B:A maker of frozen orange juice.

C:A hospital.

D:An accounting firm.

答案: 【A maker of frozen orange juice.】

3、问题:If CustomCraft uses job order costing, each of the following is true, except: 如果 CustomCraft 使用分批法进行成本核算,则以下每一项都为真,除了( )

选项:

A: Individual job cost sheets accumulate all manufacturing costs applicable to each job 单个成本计算单累计适用于每个工作的所有制造成本

B:Direct labor cost applicable to individual jobs is recorded when paid by a debit to Work in Process Inventory and a credit to Cash. 对单个订单的直接人工成本记录为:借记在产品存货,贷记现金。

C:The amount of direct materials used in individual jobs is recorded by debiting the Work in Process Inventory account and crediting the Materials Inventory account.单个订单中使用的直接材料的会计处理为:借记在产品存货,贷记库存材料存货。

D:The manufacturing overhead applied to each job is transferred from the Manufacturing Overhead accountto the Work in Process Inventory account将制造费用从分配给特定订单的成本流转是:从制造费用帐户转移到在产品存货帐户

答案: 【Direct labor cost applicable to individual jobs is recorded when paid by a debit to Work in Process Inventory and a credit to Cash. 对单个订单的直接人工成本记录为:借记在产品存货,贷记现金。】

4、问题:4. The use of activity-based costing is indicated when it is suspected that each of a firm’s product lines consumes approximately the same amount of overhead resources but the current allocation scheme assigns each line a substantially different amount. 当怀疑公司的每条产品线消耗大致相同数量的间接费用资源,但当前分配方案为每条产品线分配显着不同的数量时,就会使用基于作业的成本核算方法。 ( )

选项:

A:对

B:错

答案: 【对】

5、问题:If Power Products uses process costing, which of the following are likely to be true: ( )如果 Power Products 使用基于过程的成本计算法,以下哪项很可能是正确的:

选项:

A:The production processes are high volume. 大批量生产。

B: The products use different amounts of direct labor.产品使用不同数量的直接人工。

C:The products are created with repetitive processes. 产品是通过重复过程创建的。

D:The products are created to customer specifications.产品是按照客户规格制造的。

答案: 【The production processes are high volume. 大批量生产。;

The products are created with repetitive processes. 产品是通过重复过程创建的。】

见面课:Cost Behavior ,CVP Analysis,and Short-term decision

1、问题:Marston Company sells a single product at a sales price of $50 per unit. Fixed costs total $15,000 per month, and variable costs amount to $20 per unit. If management reduces the sales price of this product by $5 per unit, the sales volume needed for the company to break even will: ( )马斯顿公司以每件 50 美元的销售价格销售单一产品。 每月固定成本总计 15,000 美元,可变成本为每单位 20 美元。 如果管理层将该产品的售价每单位降低 5 美元,则公司实现收支平衡所需的销售额将:

选项:

A:Increase by $5,000. 增加 5,000 美元

B:Increase by $2,000. 增加 2,000 美元

C:Increase by $4,500. 增加 4,500 美元

D:Remain unchanged. 保持不变

答案: 【Increase by $2,000. 增加 2,000 美元】

2、问题:Olsen Auto Supply typically earns a contribution margin ratio of 40 percent. The store manager estimates that by spending an additional $5,000 per month for TV advertising the store will be able to increase its operating income by $3,000 per month. The manager is expecting the TV advertising to increase monthly dollar sales volume by: ( )Olsen Auto Supply 的边际贡献率通常为40%。商店经理估计,通过每月额外花费 5,000 美元用于电视广告,商店将能够增加每月3,000 美元的营业收入。经理预计电视广告将通过以下方式增加每月的销售额为( ):

选项:

A:$12,500

B:$7,500

C:$8,000

D:$20,000

答案: 【$20,000】

3、问题: Driver Company manufactures two products. Data concerning these products are shown below: Driver Company 生产两种产品,这些产品的相关数据如下所示:Product AProduct BTotal monthly demand (in units)月需要量1,000200Sales price per unit销售单价$400$500Contribution margin ratio边际贡献率30%40%Relative sales mix销售组合80%20%If fixed costs are equal to $320,000, what amount of total sales revenue is needed to break even? ( )如果固定成本等于 320,000 美元,则需要多少总销售收入才能实现收支平衡?

选项:

A:$914,286

B:$320,000

C:$457,143

D:$1,000,000

答案: 【$1,000,000】

4、问题:A company only produces one product. The relevant information for July is as follows:某公司只生产一种产品,7月份相关资料如下:销售数量 (Sales quantity) 1,000个@ $10/个可变生产成本(Variable production cost) $5.50/个固定间接成本(Fixed manufacturing overhead) $1,200可变营销成本(Variable marketing cost ) $0.5/销量固定营销成本(Fixed marketing cost) $1,000期初库存 (Beginning inventory ) 0生产数量(Production quantity) 1,200个假设在variable costing下operating income 是1800元,在absorption costing下EBIT是 ( )

选项:

A:$2,000

B:$1,800

C:$1,967

D:$2,167

答案: 【$2,000】

5、问题:Capital Company has decided to discontinue a product produced on a machine purchased four years ago at a cost of $70,000. The machine has a current book value of $30,000. Due to technologically improved machinery now available in the marketplace, the existing machine has no current salvage value. The companyis reviewing the various aspects involved in the production of a new product. The engineering staff advised that the existing machine can be used to produce the new product. Other costs involved in the production of the new product will be materials of $20,000 and labor priced at $5,000.Capital Company 已决定停产在四年前以 70,000 美元购买的机器上生产的产品。该机器的当前账面价值为 30,000 美元。 由于现在市场上有技术改进的机器,现有的机器没有当前的残值。公司正在审查新产品生产所涉及的各个方面。 工程人员建议,现有机器可用于生产新产品。 生产新产品所涉及的其他成本为 20,000 美元的材料和 5,000 美元的人工成本。lgnoring income taxes, the costs relevant to the decision to produce or not to produce the new product would be ( )忽略所得税,与决定生产或不生产新产品相关的成本为

选项:

A:$25,000

B:$30,000

C:$55,000

D:$95,000

答案: 【$25,000】

见面课:Cost Behavior, CVP Analysis, and Short-term decision

1、问题:Marston Company sells a single product at a sales price of $50 per unit. Fixed costs total $15,000 per month, and variable costs amount to $20 per unit. If management reduces the sales price of this product by $5 per unit, the sales volume needed for the company to break even will: ( )马斯顿公司以每件 50 美元的销售价格销售单一产品。 每月固定成本总计 15,000 美元,可变成本为每单位 20 美元。 如果管理层将该产品的售价每单位降低 5 美元,则公司实现收支平衡所需的销售额将:

选项:

A:Increase by $5,000. 增加 5,000 美元

B:Increase by $2,000. 增加 2,000 美元

C:Increase by $4,500. 增加 4,500 美元

D:Remain unchanged. 保持不变

答案: 【Increase by $2,000. 增加 2,000 美元】

2、问题:Olsen Auto Supply typically earns a contribution margin ratio of 40 percent. The store manager estimates that by spending an additional $5,000 per month for TV advertising the store will be able to increase its operating income by $3,000 per month. The manager is expecting the TV advertising to increase monthly dollar sales volume by: ( )Olsen Auto Supply 的边际贡献率通常为40%。商店经理估计,通过每月额外花费 5,000 美元用于电视广告,商店将能够增加每月3,000 美元的营业收入。经理预计电视广告将通过以下方式增加每月的销售额为( ):

选项:

A:$12,500

B:$7,500

C:$8,000

D:$20,000

答案: 【$20,000】

3、问题: Driver Company manufactures two products. Data concerning these products are shown below: Driver Company 生产两种产品,这些产品的相关数据如下所示:Product AProduct BTotal monthly demand (in units)月需要量1,000200Sales price per unit销售单价$400$500Contribution margin ratio边际贡献率30%40%Relative sales mix销售组合80%20%If fixed costs are equal to $320,000, what amount of total sales revenue is needed to break even? ( )如果固定成本等于 320,000 美元,则需要多少总销售收入才能实现收支平衡?

选项:

A:$914,286

B:$320,000

C:$457,143

D:$1,000,000

答案: 【$1,000,000】

4、问题:A company only produces one product. The relevant information for July is as follows:某公司只生产一种产品,7月份相关资料如下:销售数量 (Sales quantity) 1,000个@ $10/个可变生产成本(Variable production cost) $5.50/个固定间接成本(Fixed manufacturing overhead) $1,200可变营销成本(Variable marketing cost ) $0.5/销量固定营销成本(Fixed marketing cost) $1,000期初库存 (Beginning inventory ) 0生产数量(Production quantity) 1,200个假设在variable costing下operating income 是1800元,在absorption costing下EBIT是 ( )

选项:

A:$2,000

B:$1,800

C:$1,967

D:$2,167

答案: 【$2,000】

5、问题:Capital Company has decided to discontinue a product produced on a machine purchased four years ago at a cost of $70,000. The machine has a current book value of $30,000. Due to technologically improved machinery now available in the marketplace, the existing machine has no current salvage value. The companyis reviewing the various aspects involved in the production of a new product. The engineering staff advised that the existing machine can be used to produce the new product. Other costs involved in the production of the new product will be materials of $20,000 and labor priced at $5,000.Capital Company 已决定停产在四年前以 70,000 美元购买的机器上生产的产品。该机器的当前账面价值为 30,000 美元。 由于现在市场上有技术改进的机器,现有的机器没有当前的残值。公司正在审查新产品生产所涉及的各个方面。 工程人员建议,现有机器可用于生产新产品。 生产新产品所涉及的其他成本为 20,000 美元的材料和 5,000 美元的人工成本。lgnoring income taxes, the costs relevant to the decision to produce or not to produce the new product would be ( )忽略所得税,与决定生产或不生产新产品相关的成本为

选项:

A:$25,000

B:$30,000

C:$55,000

D:$95,000

答案: 【$25,000】

见面课:Preparation of Master Budget

1、问题:Which of the following statements correctly describe relationships within the master budget? ( )下列哪些陈述正确地描述了总预算内的关系?

选项:

A:The production budgets are based in large part on the sales forecast.生产预算很大程度上基于销售预测

B: In many elements of the master budget, the amounts budgeted for the upcoming quarter are reviewed andsubdivided into monthly budget figures.在总预算的许多要素中,对下一季度的预算金额进行了审查和细分为每月预算数字

C:The operating budgets affect the budgeted income statement, the cash budget, and the budgeted balance sheet.经营预算影响预算损益表、现金预算和预算资产负债表

D:The capital expenditures budget affects the direct materials budget.资本支出预算影响直接材料预算

答案: 【The production budgets are based in large part on the sales forecast.生产预算很大程度上基于销售预测;

In many elements of the master budget, the amounts budgeted for the upcoming quarter are reviewed andsubdivided into monthly budget figures.在总预算的许多要素中,对下一季度的预算金额进行了审查和细分为每月预算数字;

The operating budgets affect the budgeted income statement, the cash budget, and the budgeted balance sheet.经营预算影响预算损益表、现金预算和预算资产负债表】

2、问题:During the first quarter of its operations, Morris Mfg. Co. expects to sell 50,000 units and create an ending inventory of 20,000 units. Variable manufacturing costs are budgeted at $10 per unit, and fixed manufacturing costs at $ 100,000 per quarter. The company’s treasurer expects that 80 percent of the variable manufacturing costs will require cash payment during the quarter and that 20 percent will be financed through accounts payable and accrued liabilities. Only 50 percent of the fixed manufacturing costs are expected to require cash payments during the quarter. In the cash budget, payments for manufacturing costs during the quarter will total: 在其运营的第一季度,Morris Mfg. Co. 预计将销售 50,000 件,并有20,000 件期末库存。 可变制造成本预算为每单位 $10,固定制造成本为每季度 100,000 美元。 该公司的财务主管预计,本季度 80% 的可变制造成本将需要现金支付,20% 将通过应付账款和应计负债提供资金。 预计本季度只有 50% 的固定制造成本需要现金支付。 在现金预算中,本季度支付的制造成本总计:( )

选项:

A:$800,000

B:$610,000

C:$600,000

D:$450,000

答案: 【$610,000】

3、问题:Rodgers Mfg. Co. prepares a flexible budget. The original budget forecasts sales of 100,000 units @ $20 and operating expenses of $300,000 fixed, plus $2 per unit. Production was budgeted at 100,000 units. Actual sales and production for the period totaled 110,000 units. When the budget is adjusted to reflect these new activity levels, which of the following budgeted amounts will increase, but by less than 10 percent?Rodgers Mfg. Co. 编制弹性预算。最初的预算预测销售额为 100,000 件 @ 20 美元,运营费用为 300,000 美元,加上每件 2 美元。 生产预算为 100,000 台。期内实际产销量合计11万件。 当调整预算以反映这些新的活动水平时,以下哪一项预算金额会增加,但增幅小于 10%?( )

选项:

A:Sales revenue.销售收入

B:Variable manufacturing costs.可变的制造成本

C:Fixed manufacturing costs.固定制造成本

D:Total operating expenses. 总运营费用

答案: 【Total operating expenses. 总运营费用】

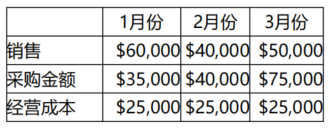

4、问题: ABC’s cash balance at the beginning of the quarter was $85,000. The company’s budget information for the first quarter is as follows:ABC公司季度初的cash balance为$85,000。该公司第一季度的预算信息如下所示: All sales are on credit, and the accounts receivable will be recovered in the second month after the sale (that is, the sales payment in January will be recovered in March). The purchase price will be paid one month after the purchase, while the operating cost is paid in the current period. If the loan agreement requires ABC to hold at least $5,000 in cash, what is the amount the company needs to borrow at the end of the quarter?所有的销售都是on credit,账款会在销售之后的第二个月收回(即1月份的销货款在3月份收回)。购货款会在采购之后的一个月支付,而经营成本(operating cost)是在当期支付的。如果贷款协议要求ABC至少持有$5,000现金,那么该公司在季度末需要借款的金额是多少?( )

All sales are on credit, and the accounts receivable will be recovered in the second month after the sale (that is, the sales payment in January will be recovered in March). The purchase price will be paid one month after the purchase, while the operating cost is paid in the current period. If the loan agreement requires ABC to hold at least $5,000 in cash, what is the amount the company needs to borrow at the end of the quarter?所有的销售都是on credit,账款会在销售之后的第二个月收回(即1月份的销货款在3月份收回)。购货款会在采购之后的一个月支付,而经营成本(operating cost)是在当期支付的。如果贷款协议要求ABC至少持有$5,000现金,那么该公司在季度末需要借款的金额是多少?( )

选项:

A:$0

B:$5,000

C:$10,000

D:$45,000

答案: 【$10,000】

5、问题:ABC company sells products on credit. Based on past experience, there are the following collection methods: 60% of the payment is collected in the month of sale, and 25% is collected within one month after the sale. 15% is recovered within two months after the sale, and bad debt is negligible.ABC公司以赊销(on credit)的方式出售产品,根据以往的经验有以下的收款(collection)方式:60%的货款在销售的当月收回,25%在销售之后的一个月内收回,15%在销售之后的两个月内收回,坏账(bad debt)忽略不计。Customers who pay for the goods in the month of sale can get a 2% discount (cash discount). If the sales from January to April are $220,000, $200,000, $280,000, and $260,000, then the balance of ABC’s accounts receivable on May 1st is( )在销售当月支付货款的客户可以获得2%的折扣(cash discount)。如果1月到4月的销售额分别是$220,000、$200,000、$280,000和$260,000,那么ABC 5月1日应收账款(accounts receivable)的余额为( )

选项:

A:$107,120

B:$143,920

C:$146,000

D:$204,000

答案: 【$146,000】

见面课:Standard Costs and Variance Analysis

1、问题:The labor rate variance is determined by multiplying the difference between the actual labor rate and the standard labor rate by:( ) 直接人工工资率差异是用实际人工费率与标准人工费率之差乘以:

选项:

A:The standard labor hours allowed for a given level of output.给定产出水平所允许的标准工时。

B: The standard labor rate.标准人工费率。

C:The actual hours worked during the period.期间的实际工作时间。

D: The actual labor rate. 实际人工费率。

答案: 【The actual hours worked during the period.期间的实际工作时间。】

2、问题:Which of the following is not a possible cause of an unfavorable direct labor efficiency variance?( ) 下列哪项不是造成不利的直接劳动效率差异的可能原因?

选项:

A:Lack of motivation. 缺乏激励

B:Low-quality materials.劣质材料

C:Poor supervision.监督不力

D:All of the selections could be considered possible causes of an unfavorable labor efficiency variance.所有的选项都可以被认为是不利的劳动效率差异的可能原因。

答案: 【All of the selections could be considered possible causes of an unfavorable labor efficiency variance.所有的选项都可以被认为是不利的劳动效率差异的可能原因。】

3、问题:An unfavorable overhead volume variance indicates that:( )不利的间接费用业务量差异表明:

选项:

A:Total fixed overhead has exceeded the standard amount budgeted.总固定费用已超过预算的标准金额

B:Variable overhead per unit has exceeded the standard amount budgeted.单位可变间接费用已超出预算标准金额

C:Actual production was less than the normal volume of output.实际产量低于正常产量

D:Actual production was more than the normal volume of output.实际产量超过正常产量

答案: 【Actual production was less than the normal volume of output.实际产量低于正常产量】

4、问题:A favorable overhead spending variance means that:( )有利的间接费用开支差异意味着:

选项:

A:Overhead has been overapplied.制造费用进行了超计划分配

B:Overhead has been underapplied.分配的制造费用比制造费用的实际发生额少。

C:Actual production was less than the normal volume of output.实际产量低于正常产量

D:None of the selections is correct.没有一个选择是正确的

答案: 【None of the selections is correct.没有一个选择是正确的】

5、问题:Modern Art, Inc., produces handpainted foam mouse pads. The following budgeted and actual results are for a recent month in which actual production was equal to budgeted production.Modern Art, Inc. 生产手绘泡沫鼠标垫。以下是最近一个月的预算和实际结果,实际产量等于预算产量。Budgeted AmountActual ResultDirect materials: Foam Usage1.5 square feet per pad1.3 square feet per pad Price$0.15 per square foot$0.18 per square footDirect labor:Usage.25 hours per pad.30 hours per pad Price$15 per hour$13 per hourWhich of the following are true? ( )

选项:

A:The materials price variance is favorable.材料价格差异是有利的

B:The direct labor rate variance is favorable.直接人工费率差异是有利的

C:The materials quantity variance is unfavorable.直接材料数量差异是不利。

D:The direct labor efficiency variance is unfavorable.直接人工效率差异是不利的

答案: 【The direct labor rate variance is favorable.直接人工费率差异是有利的;

The direct labor efficiency variance is unfavorable.直接人工效率差异是不利的】

见面课:Standard Costs and Variances

1、问题:The labor rate variance is determined by multiplying the difference between the actual labor rate and the standard labor rate by:( ) 直接人工工资率差异是用实际人工费率与标准人工费率之差乘以:

选项:

A:The standard labor hours allowed for a given level of output.给定产出水平所允许的标准工时。

B: The standard labor rate.标准人工费率。

C:The actual hours worked during the period.期间的实际工作时间。

D: The actual labor rate. 实际人工费率。

答案: 【The actual hours worked during the period.期间的实际工作时间。】

2、问题:Which of the following is not a possible cause of an unfavorable direct labor efficiency variance?( ) 下列哪项不是造成不利的直接劳动效率差异的可能原因?

选项:

A:Lack of motivation. 缺乏激励

B:Low-quality materials.劣质材料

C:Poor supervision.监督不力

D:All of the selections could be considered possible causes of an unfavorable labor efficiency variance.所有的选项都可以被认为是不利的劳动效率差异的可能原因。

答案: 【All of the selections could be considered possible causes of an unfavorable labor efficiency variance.所有的选项都可以被认为是不利的劳动效率差异的可能原因。】

3、问题:An unfavorable overhead volume variance indicates that:( )不利的间接费用业务量差异表明:

选项:

A:Total fixed overhead has exceeded the standard amount budgeted.总固定费用已超过预算的标准金额

B:Variable overhead per unit has exceeded the standard amount budgeted.单位可变间接费用已超出预算标准金额

C:Actual production was less than the normal volume of output.实际产量低于正常产量

D:Actual production was more than the normal volume of output.实际产量超过正常产量

答案: 【Actual production was less than the normal volume of output.实际产量低于正常产量】

4、问题:A favorable overhead spending variance means that:( )有利的间接费用开支差异意味着:

选项:

A:Overhead has been overapplied.制造费用进行了超计划分配

B:Overhead has been underapplied.分配的制造费用比制造费用的实际发生额少。

C:Actual production was less than the normal volume of output.实际产量低于正常产量

D:None of the selections is correct.没有一个选择是正确的

答案: 【None of the selections is correct.没有一个选择是正确的】

5、问题:Modern Art, Inc., produces handpainted foam mouse pads. The following budgeted and actual results are for a recent month in which actual production was equal to budgeted production.Modern Art, Inc. 生产手绘泡沫鼠标垫。以下是最近一个月的预算和实际结果,实际产量等于预算产量。Budgeted AmountActual ResultDirect materials: Foam Usage1.5 square feet per pad1.3 square feet per pad Price$0.15 per square foot$0.18 per square footDirect labor:Usage.25 hours per pad.30 hours per pad Price$15 per hour$13 per hourWhich of the following are true? ( )

选项:

A:The materials price variance is favorable.材料价格差异是有利的

B:The direct labor rate variance is favorable.直接人工费率差异是有利的

C:The materials quantity variance is unfavorable.直接材料数量差异是不利。

D:The direct labor efficiency variance is unfavorable.直接人工效率差异是不利的

答案: 【The direct labor rate variance is favorable.直接人工费率差异是有利的;

The direct labor efficiency variance is unfavorable.直接人工效率差异是不利的】

第一章 单元测试

1、 问题:

Which of the following management responsibilities often involves evaluating the results of operations against the budget? ( )

选项:

A:Planning

B:Directing

C:Controlling

D:None of the all

答案: 【

Controlling

】

2、 问题:Managerial accounting differs from financial accounting in that managerial accounting ( )

选项:

A:tends to report on the company as a whole rather than segments of the company.

B:emphasizes data relevance over data objectivity

C:is used primarily by external decision makers

D:is required by Generally Accepted Accounting Principles (GAAP).

答案: 【

emphasizes data relevance over data objectivity

】

3、 问题:Which of the following corporate positions is responsible for general financial accounting, managerial accounting, and tax reporting? ( )

选项:

A:Controller

B:Treasurer

C:Internal audit

D:Chief operating officer (COO)

答案: 【

Controller

】

4、 问题:

Of the following skills, which are needed by today's management accountants? ( )

选项:

A:Strategic thinking

B:Cost management

C:Decision analysis

D:All choices are correct

答案: 【

All choices are correct

】

5、 问题:Which of the following professional standards requires management accountants to continually develop their knowledge and skills? ( )

选项:

A:Competence

B:Confidentiality

C:Integrity

D:Credibility

答案: 【

Competence

】

6、 问题:Critical thinking can be improved by asking yourself a series of questions about any issue or problem you encounter. These questions, for example, include: What is the objective? What data will I need? What assumptions am I making? Is my conclusion logical? .( )

选项:

A:对

B:错

答案: 【

对

】

7、 问题:

Which of the following requires the company's CEO and CFO to assume responsibility for the company's financial statements and disclosures? ( )

选项:

A:

Sarbanes-Oxley Act of 2002 (SOX)

B:

Institute of Management Accountants (IMA)

C:Enterprise Resource Planning (ERP)

D:Lean operations

答案: 【

Sarbanes-Oxley Act of 2002 (SOX)

】

8、 问题:Which of the following is false? ( )

选项:

A:Globalization has increased the necessity for more detailed and accurate cost information .

B:The triple bottom line focuses on three items: net income, net assets, and return on investment .

C:ERP systems integrate information from all company functions into a centralized data warehouse.

D:Lean operations is a philosophy and business strategy of operating without waste .

答案: 【

The triple bottom line focuses on three items: net income, net assets, and return on investment .

】

9、 问题:

All of the following are business trends affecting management accounting ( )

选项:

A:shifting economy.

B:sustainability .

C:big data .

D:All choices are correct

答案: 【

All choices are correct

】

10、 问题:Which TWO of the following statements about management accounting information are true?( )

选项:

A:They may include non-financial information

B:They are required by law to be produced

C:They are used to aid planning

D:They are for use by parties external to the organization

答案: 【

They may include non-financial information

They are used to aid planning

】

第二章 单元测试

1、 问题:Which of the following costs are treated as product costs by a merchandising company, such as Walmart? ( )

选项:

A:Cost of import duties paid on merchandise purchased from overseas suppliers

B:Cost of shipping merchandise to the store

C:Cost of merchandise purchased for resale

D:Cost of designing and operating the company’s website

答案: 【

Cost of import duties paid on merchandise purchased from overseas suppliers

Cost of shipping merchandise to the store

Cost of merchandise purchased for resale

】

2、 问题:

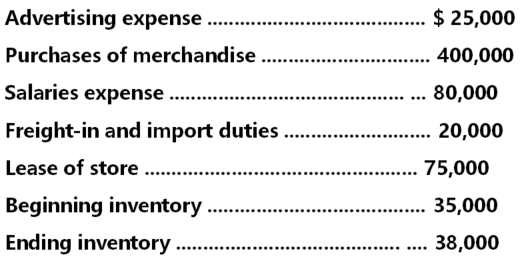

Ralph’s Sporting Goods is a merchandising company, given the following information, the Cost of Goods Sold is 417,000 ( )

选项:

A:对

B:错

答案: 【

对

】

3、 问题:

Which of the following types of companies would have work in process inventory? ( )

选项:

A:Service

B:Merchandising

C:Manufacturing

D:All choices are correct

答案: 【

Manufacturing

】

4、 问题:Which of the following is not an activity in the value chain? ( )

选项:

A:Marketing

B:Customer Service

C:Design

D:Administration

答案: 【

Administration

】

5、 问题:A cost that can be traced to a cost object is known as a ( )

选项:

A:period cost .

B:product cost .

C:direct cost .

D:indirect cost .

答案: 【

direct cost .

】

6、 问题:Conversion costs consist of ( )

选项:

A:direct materials and manufacturing overhead

B:direct labor and manufacturing overhead

C:direct materials and direct labor

D:direct materials, direct labor, and manufacturing overhead .

答案: 【

direct labor and manufacturing overhead

】

7、 问题:Which of the following is part of manufacturing overhead? ( )

选项:

A:Period costs, such as depreciation on office computers

B:Indirect materials, such as machine lubricants

C:Indirect labor, such as plant forklift operators’ wages

D:Other indirect manufacturing costs, such as plant utilities .

答案: 【

Indirect materials, such as machine lubricants

Indirect labor, such as plant forklift operators’ wages

Other indirect manufacturing costs, such as plant utilities .

】

8、 问题:The average cost per unit can be used for predicting total costs at many different output levels ( )

选项:

A:对

B:错

答案: 【

错

】

9、 问题:Sunk costs are generally relevant to decisions ( )

选项:

A:对

B:错

答案: 【

错

】

10、 问题:Which of the following types of companies will always have the Cost of Goods Sold account on their income statements? ( )

选项:

A:Service and merchandising companies

B:Merchandising and manufacturing companies

C:Service and manufacturing companies

D:Service, merchandising, and manufacturing companies

答案: 【

Merchandising and manufacturing companies

】

第三章 单元测试

1、 问题:For which of the following would job costing not be appropriate? ( )

选项:

A:Electrician

B:Manufacturer of mass-produced beverages

C:Law firm

D:Manufacturer of custom-ordered production equipment

答案: 【

Manufacturer of mass-produced beverages

】

本文章不含期末不含主观题!!

本文章不含期末不含主观题!!

支付后可长期查看

有疑问请添加客服QQ 2356025045反馈

如遇卡顿看不了请换个浏览器即可打开

请看清楚了再购买哦,电子资源购买后不支持退款哦