2022知到答案 金融风险管理(上海杉达学院) 最新知到智慧树满分章节测试答案

第一章 单元测试

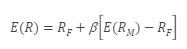

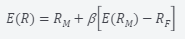

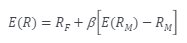

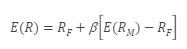

1、 问题:Which formula describe the Capital Asset Pricing Model?( )

选项:

A:

B:

C:

答案: 【

】

2、 问题:Which of the following descriptions are the assumption for Capital Asset Pricing Model?( )

选项:

A:Investors care only about expected return and standard deviation of return.

B:The  ‘s of different investments are independent.

‘s of different investments are independent.

C:Investors focus on returns over one period.

D:All investors can borrow or lend at the same risk-free rate.

E:Tax does not influence investment decisions.

F:All investors make the same estimates of  .

.

答案: 【

Investors care only about expected return and standard deviation of return.

The  ‘s of different investments are independent.

‘s of different investments are independent.

Investors focus on returns over one period.

All investors can borrow or lend at the same risk-free rate.

Tax does not influence investment decisions.

All investors make the same estimates of  .

.

】

3、 问题:The return from the market last year was 10% and the risk-free rate was 5%. A hedge fund manager with a beta of 0.6 has an alpha of 4%. What return did the hedge fund manager earn?( )

选项:

A:0.15

B:0.12

C:0.10

答案: 【

0.12

】

4、 问题:Suppose the S&P 500 Index has an expected annual return of 7.2% and volatility of 8.2%. Suppose Andromeda Fund has an expected annual return of 6.8% and volatility of 7.0% and is benchmarked against the S&P 500 Index. According to the CAPM, if the risk-free rate is 2.2% per year, what is the beta of the Andromeda Fund?( )

选项:

A:0.20

B:0.90

C:0.92

D:1.23

答案: 【

0.92

】

5、 问题:If a bond issued by a company have a rating of AAA, the company generally can not be referred to as having a rating of AA.( )

选项:

A:对

B:错

答案: 【

对

】

第二章 单元测试

1、 问题:Which of the following table reflects the change of structure of banking in the United States between 1984 and 2017?( )

选项:

A:

B:

C:

答案: 【

】

2、 问题:__ measures the return to stockholders on their investment in the bank. It is the product of net profit margin, asset utilization and the equity multiplier.( )

选项:

A:ROA

B:ROE

C:Net profit margin

答案: 【

ROE

】

3、 问题:Loan losses on the income statement of DLC Bank is associated with operational risk.( )

选项:

A:对

B:错

答案: 【

错

】

4、 问题:Net interest income on the income statement of DLC Bank is associated with market risk.( )

选项:

A:对

B:错

答案: 【

对

】

5、 问题:Non-interest expense on the income statement of DLC Bank is associated with credit risk.( )

选项:

A:对

B:错

答案: 【

错

】

第三章 单元测试

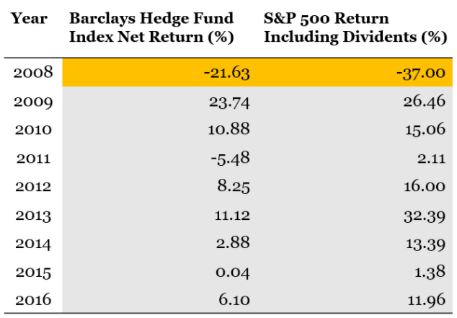

1、 问题:Select one or more correct statements about the performance of hedge fund:

( )

选项:

A:The Barclays Hedge Fund Index shows that hedge funds outperformed the market in 2008, but not between 2009 and 2016

B:Many hedge fund strategies have low betas and therefore cannot be expected to outperform the market when it is doing well

C:The statistics may bias average hedge fund performance upward because only hedge funds that choose to report their returns are included in the statistics and these tend to be the hedge funds that are doing well

答案: 【

The Barclays Hedge Fund Index shows that hedge funds outperformed the market in 2008, but not between 2009 and 2016

Many hedge fund strategies have low betas and therefore cannot be expected to outperform the market when it is doing well

The statistics may bias average hedge fund performance upward because only hedge funds that choose to report their returns are included in the statistics and these tend to be the hedge funds that are doing well

】

本文章不含期末不含主观题!!

本文章不含期末不含主观题!!

支付后可长期查看

有疑问请添加客服QQ 2356025045反馈

如遇卡顿看不了请换个浏览器即可打开

请看清楚了再购买哦,电子资源购买后不支持退款哦